Applying for a car loan can look eg really challenging business. Perhaps you’re a graduating scholar, maybe you work in trading, or you might be merely entering the team. Either way, you are stepping out on genuine, doing work globe, therefore you desire an automobile to get it done. It might seem challenging, however, we’re right here to tell your it is such much easier than just it appears.

A car loan is not a guaranteed unsecured loan

Straight-out of your own gate, it is important to know what a car loan isnt. A protected unsecured loan are financing the place you developed something entitled collateral, which is a bit of well worth which you currently own, just like the security against taking right out what kind of cash you are requesting. Guarantee is generally something like a car or truck, or assets, that’s not one thing everyone underneath the age of 21 is going to has. You’ll be able for somebody more to hold the latest equity (i.e. to hold some thing out of theirs), hence individual could well be titled a beneficial guarantor.

Regardless, car finance isnt like a secured personal bank loan where it’s not necessary to put up security to become accepted. This will make it easier for people beneath the years regarding 21 (particularly your self) to locate you to definitely.

As to the reasons score an auto loan?

- Pre-accepted auto loans are just like which have profit the lending company. When you find yourself younger and you may going after very first vehicles, it helps knowing the specific funds you have so as that you could go searching on the proper towns. They also signify you might negotiate such a cash-in-hands customer with car dealers, as opposed to waiting around for acceptance for the a cost. However, it is critical to keep in mind that the auto will need to feel appropriate towards the loan providers to utilize due to the fact security. Possibly, it means the financial institution could see their really worth below new considering speed. In these instances, the vendor needs to sometimes reduce the price to match new lender’s standards or the visitors has to see an even more compatible mortgage.

- The interest rates we offer are repaired, so we don’t change them on you mid-way through the loan term.

- You could extend the loan title for a time period of upwards in order to 5 years which means that your weekly repayments fall off. This tends to make budgeting and you can preserving much easier on enough time-title, since there might be no slutty shocks on the all of our end. The term of your financing are very different across loan providers and you can circumstances such whether or not the vehicles is completely new together with loan amount may differ.

- You should use your car, whether or not it enjoys guarantee inside, for capital things aside from a car. We know how existence happens, and frequently you want you to extra money from the lender to own certain unforeseen situations. Being on the rear ft if you’re only typing mature existence is going to be hard, so if the automobile mortgage is used getting something else entirely, we obtain it.

- We’re going to consider your to have an auto loan even if you have a student licenses! As long as you was a license-holder, there will be our ear canal.

Let’s Fall apart Car finance

Before deciding about how far you’re going to sign up for, you must know where you stand economically. Listed below are some points to consider:

step 1. Borrowing from the bank

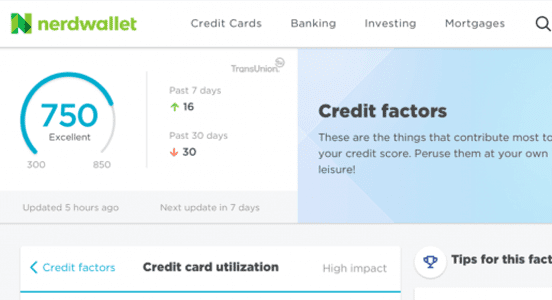

What is your credit score? A credit rating is what insurance companies and you can banks used to glance at just how probably it is which you are able to spend your costs to the go out. It’s lots ranging from 0 and a lot of the better the greater. Your credit rating will dictate their installment program: that’s, this will help to us to ount you can utilize obtain. Check your credit score and acquire more information on it here.

dos. Your almost every other economic commitments

Do you have an educatonal loan or other particular loan? This can in addition to change the number you need to use acquire getting car loan.

step 3. Money

How much could you currently earn? Money is generally analyzed when it comes to your own total income, online payday loans California when you enjoys multiple jobs while having particular service from your mother and father, which is factored in as well. The greater your earnings, the greater you are most likely in a position to submit an application for.

4. Mortgage numbers and you can words

Finally, you need to considercarefully what proportions auto loan you are searching for, as well as how rapidly we wish to pay it back. Thought the loan particularly an elastic band: the newest extended you stretch it out, the newest slimmer its. Very, if you’d like to repay your loan more a short span the newest weekly money might possibly be larger, just in case you want to repay it over a longer title (which you’ll) the new money could be reduced. Keep in mind that notice try the one thing here, an average desire i charge is around 17%.

Will you be an auto loan?

Look at the credit history, and make sure you are sure that the money you owe adequate to create the best decision. Think of exactly how much auto loan you desire otherwise need. Our finance calculator would be a lot of let here, because it will show you a price of the each week money for the picked loan amount and you will identity. Ultimately, reach out to own an easy investigations or call us now! The professionals are on give to provide the recommendations you you desire.