Shortly after the called for files are registered in addition to verification procedure is performed, the mortgage, if the approved, are disbursed in this seven working days because of the bank

Paying the borrowed funds It could be paid in the form of EMIs thru post-dated cheques (PDC) used go for of one’s bank otherwise by launching a good mandate allowing fee through the Digital Clearing Functions (ECS) system.

Prepayment/foreclosure fees If you pay-off the loan prior to the tenure enjoys complete, you earn recharged an extra percentage called prepayment/foreclosure charge/penalty. Which punishment usually selections between step 1 and you can 2% of the prominent a good. Certain finance companies, not, charge a higher add up to foreclose financing.

Difference in area fee, prepayment and you can preclosure *Part payment: Which number is actually lower than an entire loan dominant count and you may is generated before the loan amount will get owed.

*Prepayment: When you pay back the loan in part earlier gets owed according to the EMI plan. This new prepayment matter ount. Additionally, of numerous finance companies do not let prepayment/preclosure regarding financing just before a designated number of EMIs were done.

*Preclosure: They relates to completely paying off a personal bank loan before mortgage tenure has ended. Same as prepayment charges, preclosure charge start around 2- 5% of your loan amount.

Mortgage approval procedure The newest approval is at really the only discretion out-of the loan sanctioning administrator whoever choice lies in the fresh criteria specified from the lender/financial institution. The entire procedure usually takes anywhere between 48 hours and from the a few weeks. Perform remain the called for documents able including PDC and you will/otherwise closed ECS function to prevent delays within the loan running and you may disbursement.

Defaulting for the planned EMIs For folks who miss their planned EMIs and you can can not create upcoming repayments, the lending company first will endeavour to recover the newest due matter because of agreements and recuperation representatives. If such as for instance initiatives falter and your financing membership is actually designated as a default, the mortgage will show up in your credit history due to the fact good default, adversely affecting your credit score and it is therefore burdensome for your to find financing and bank card approvals in the future.

A major percentage of the 1st EMIs is basically regularly pay back the attention owed on your financing

Income tax professionals Though signature loans normally have no income tax positives, but when you grab one to for domestic home improvements/downpayment, you may be entitled to I-T deduction less than Point 24. However, so it income tax benefit is bound to simply the attention, perhaps not the primary number. And, in order to claim deduction, you will have to present right receipts.

Balance transfer give A lender, sometimes, will allow you to import the bill (amount however getting paid off) on the loan about introduce bank to some other that. New bank pays off of the equilibrium amount to brand new introduce bank. After the bill transfer process, you are going to owe the fresh lender costs along with relevant interest one is actually left on your financing.

A balance import helps you benefit from the lower interest provided by this new lender, but not, you will find some charge like harmony import commission, prepayment fees, an such like., that is certainly relevant.

So why do my initial EMIs don’t have a lot of influence on the https://www.paydayloan4less.com/payday-loans-ny/ main amount due? This process is named “front side loading”, and therefore only a small part of the principal is paid off initial. As you improvements subsequent together with your EMIs, these types of brief ount add up, causing a beneficial ount. More substantial part of the EMI is actually, for this reason, always pay back the loan prominent during the retirement.

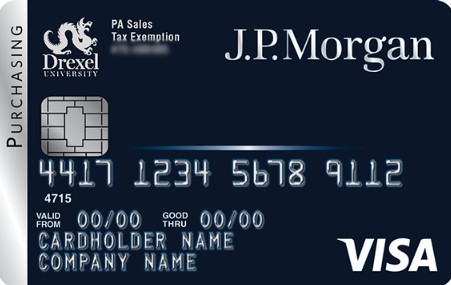

Unsecured loan in the place of mortgage against charge card Credit card financing is actually a deal that you may have the ability to avail on your credit. Such as that loan is just applicable to certain cards and you are only able to strategy the card company for a loan inside. In terms of an unsecured loan, as well, you might approach any lender. Furthermore, in place of a personal loan software, credit fund don’t require any additional files.