Credit score rating unions already have an alternative way available members fast access to funds without any highest interest rates, rollovers and inflate payments that escort old-fashioned payday financial loans. In Sep 2019, the state Credit Union group (NCUA) deck approved a last guideline permitting loans unions to offer an additional payday alternative loan (partner) their customers.

The NCUA authorized loans unions to begin the process promoting this brand new  option (known as PAL Two) efficient December 2, 2019. Loan unions can offer both the established pay check optional loan solution (PAL we) plus PAL II; however, credit unions are merely authorized available one sort of mate per manhood at any time.

option (known as PAL Two) efficient December 2, 2019. Loan unions can offer both the established pay check optional loan solution (PAL we) plus PAL II; however, credit unions are merely authorized available one sort of mate per manhood at any time.

Precisely why setup a fresh payday solution mortgage alternative? As reported by the NCUA, the purpose behind buddy Two would be to offer a much more competitive alternative to popular old-fashioned payday loans, and even to fulfill the requirements of members which are not just answered employing the found mate.

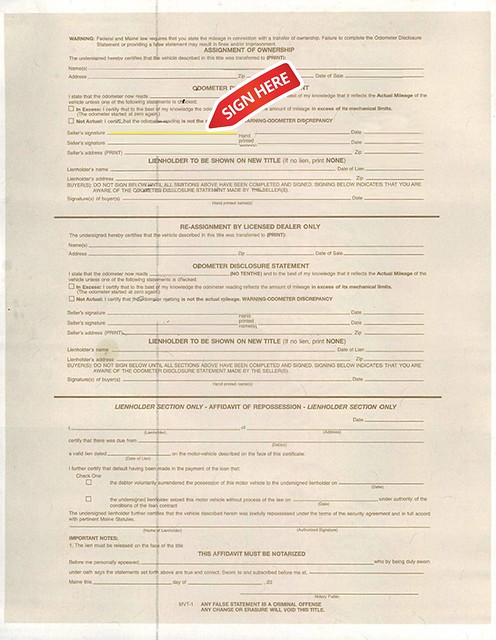

Finding the important differences between these payday alternate finance varieties? The flexibility of this friend II allows loan unions provides a more substantial money with an extended payback course, and takes away the necessity for a borrower to enjoy recently been an associate associated with the credit union for example period before acquiring a PAL Two. Important areas of distinction between with the two options are summarized through the below guide.

What’s staying exactly the same? Some options PAL we stay unaltered for buddy Two, most notably:

With partner I debts, debt unions are needed to create lowest expectations for PAL Two that equilibrium their unique customers’ requirement for fast access to finances with sensible underwriting. The underwriting tip obligations are identical for PAL we and partner Two, which include documentation of proof earnings, among other reasons.

Great things about brand new cash advance option

Incorporating the mate II debt alternative makes it possible for increased mobility for debt unions to help their particular people with large buck problems, while sparing all of them the adverse economic problems of a typical payday loan. To position customers for increased economical security throughout the long-range, several credit score rating unions have got constructed economic literacy needs and perks to their PAL tools, including assets advice, benefit ingredients, perks for payroll reduction for loan payments or reporting of buddy funds to credit agencies to further improve user creditworthiness.

Measures gadgets

Credit unions should consider this newer money selection and judge whether its a good fit due to their customers. A credit device that opts to advance must revise the loan plan before supplying mate II financial loans. Otherwise, they could be subjected to regulatory danger and scrutiny. A credit union’s panel of owners must approve the decision to supply companion Two.

RKL’s staff of depository financial institution experts will your own credit union effectively prepare for and carry out partner II as a unique mortgage product or service promoting and be sure regulatory agreement. Email us correct making use of the kind at the bottom with this page and learn more about many tips we all serve the conformity, regulatory and advisory goals of financial institutions during the Mid-Atlantic.

Contributed by Jennifer Mitchell, MAcc, elder relate in RKL’s possibilities Management rehearse. Jennifer provides the bookkeeping and chances maintenance requires of monetary treatments business visitors, with a primary target account unions. She concentrates on affiliate companies financing and consumer loaning.